January 18, 2026 – Even as international scrutiny intensifies over accusations of genocide and human rights violations in Gaza—where the ongoing conflict has resulted in tens of thousands of Palestinian casualties and widespread destruction—Israel’s economy continues to thrive on the global stage. In 2025, the nation inked a series of record-breaking multibillion-dollar agreements across the energy, technology, and defense sectors, demonstrating remarkable resilience and strategic positioning amid geopolitical turbulence. These deals not only bolster Israel’s financial standing but also underscore shifting alliances and the prioritization of economic interests over humanitarian concerns by some international partners.

The paradox is stark: while human rights organizations and several governments condemn Israel’s military operations in Gaza, labeling them as potential war crimes under international law, major corporations and nations have deepened ties with Tel Aviv. This trend highlights a complex interplay of realpolitik, where strategic imperatives in energy security, technological innovation, and military capabilities often eclipse ethical debates. Below, we explore the key sectors driving this economic surge, drawing on publicly available data and expert analyses to provide a comprehensive overview.

Surging Gas Exports: Energy Deals Fueling Regional Ties

Israel’s natural gas sector has emerged as a powerhouse, with offshore discoveries in the Eastern Mediterranean transforming the country into a significant exporter. Despite the Gaza conflict, which has drawn criticism from bodies like the United Nations for disproportionate civilian impacts, Israel secured unprecedented energy agreements in 2025.

One standout deal was a $35 billion natural gas export agreement with Egypt, announced in December 2025. This pact involves supplying liquefied natural gas (LNG) from Israel’s Leviathan and Tamar fields to Egyptian facilities for re-export to Europe. The agreement, facilitated through partnerships with companies like Chevron and NewMed Energy, aims to meet growing European demand amid efforts to reduce reliance on Russian supplies. Egyptian officials praised the deal for enhancing bilateral economic cooperation, even as critics pointed to the irony of Cairo’s involvement given regional tensions over Gaza.

Further afield, Israel expanded its reach with multibillion-dollar commitments from European buyers. For instance, a consortium including Germany’s RWE and Italy’s Eni signed contracts worth over $10 billion for long-term LNG deliveries, positioning Israel as a key player in the continent’s energy transition. These deals come at a time when global gas prices remain elevated due to supply chain disruptions, allowing Israel to capitalize on its reserves estimated at over 1 trillion cubic meters.

Analysts attribute this success to Israel’s advanced extraction technologies and strategic pipelines, such as the EastMed project discussions. However, the prosperity contrasts sharply with Gaza’s humanitarian crisis, where fuel shortages have crippled hospitals and water treatment plants, exacerbating famine risks as reported by aid groups like Oxfam.

Tech Boom: Investments Pour In Despite Boycott Calls

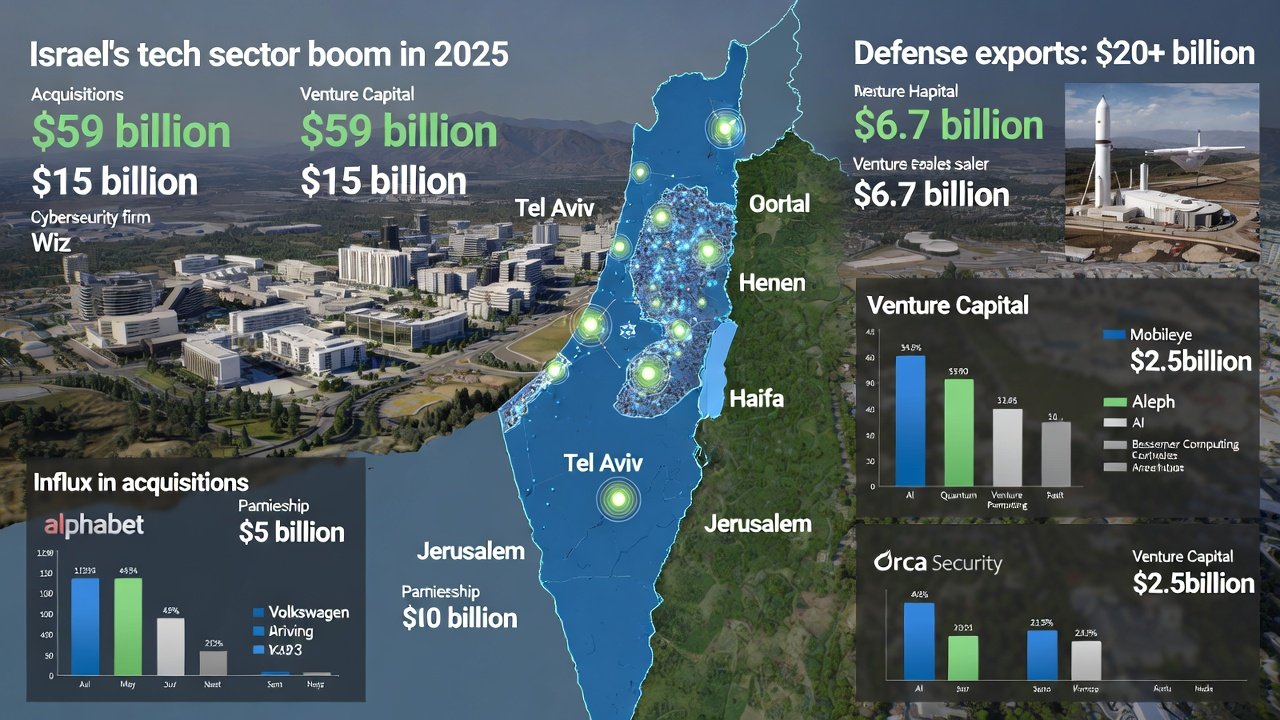

Israel’s “Startup Nation” moniker held firm in 2025, with the tech sector attracting nearly $59 billion in acquisitions, public listings, and venture capital—a staggering 340% increase from the previous year. This influx occurred amid global boycott, divestment, and sanctions (BDS) movements targeting Israel over its Gaza policies, which activists describe as genocidal intent through systematic displacement and bombardment.

Major highlights include the $15 billion acquisition of Israeli cybersecurity firm Wiz by Alphabet (Google’s parent company), marking one of the largest tech deals in history. Wiz’s cloud security solutions have been adopted by Fortune 500 companies, underscoring Israel’s dominance in AI, cybersecurity, and software-as-a-service (SaaS). Similarly, Mobileye, an Intel subsidiary specializing in autonomous driving tech, secured a $5 billion partnership with Volkswagen for advanced driver-assistance systems, expanding Israel’s footprint in the automotive industry.

Venture funding also soared, with firms like Aleph and Bessemer Venture Partners channeling billions into startups focused on AI, biotech, and quantum computing. A notable example is the $2.5 billion investment in Orca Security by a consortium led by Singapore’s Temasek Holdings, aimed at enhancing cloud vulnerability detection. These deals reflect Israel’s robust innovation ecosystem, supported by government incentives and a highly educated workforce, many of whom have military backgrounds from units like the elite 8200 intelligence corps.

Critics argue that such investments indirectly fund the conflict, as tech developed in Israel—ranging from surveillance drones to AI-driven targeting systems—has been linked to operations in Gaza. Nonetheless, economic pragmatism prevails, with investors citing Israel’s track record of high returns and technological edge as overriding factors.

Weapons and Defense: Record Exports Amid Arms Embargo Debates

Perhaps the most controversial aspect of Israel’s economic gains is its defense industry, which saw exports exceed $20 billion in 2025—potentially the highest on record, with final figures expected mid-2026. Despite calls for arms embargoes from human rights advocates over Gaza allegations, nations continued to procure Israeli weaponry, viewing it as battle-tested and reliable.

A flagship deal was the over $6.7 billion agreement with Germany for advanced missile defense systems, including the Arrow 3 interceptor co-developed with Boeing. This pact, the largest in Israel’s defense history, enhances Europe’s air defense amid threats from Russia and other actors. Similarly, India renewed multibillion-dollar contracts for Israeli drones and radar systems, building on a longstanding partnership valued at $10 billion over the past decade.

Other notable transactions include sales of Rafael’s Spike missiles to Eastern European nations and Elbit Systems’ electronic warfare suites to the U.S. military. Israel’s Iron Dome and David’s Sling systems, proven in real-world scenarios, remain hot commodities, with exports to countries like Azerbaijan and the Philippines totaling several billions.

This arms trade persists despite International Court of Justice proceedings examining genocide claims in Gaza, where Israeli munitions have been implicated in civilian deaths. Proponents argue that these deals strengthen global security alliances, while detractors see them as enabling further conflict.

Broader Implications: Economics vs. Ethics in a Divided World

Israel’s ability to secure these record deals—totaling over $100 billion across sectors in 2025—illustrates a disconnect between geopolitical rhetoric and economic realities. While some nations, like Turkey and South Africa, have curtailed ties over Gaza concerns, major powers including the U.S., Germany, and India prioritize strategic partnerships. U.S. aid alone, at $3.8 billion annually through 2028, provides a foundational boost, supplemented by private sector inflows.

Experts suggest this resilience stems from Israel’s diversified economy, innovation-driven growth, and adept diplomacy. However, it raises ethical questions: How can multibillion-dollar prosperity coexist with accusations of mass atrocities? As the Gaza conflict drags on, with over 40,000 reported deaths and displacement of millions, the international community faces pressure to reconcile trade with accountability.

Looking ahead, 2026 could see further expansion, with talks of new gas pipelines to Europe and tech hubs in the Gulf. Yet, escalating tensions with Iran and potential U.S. policy shifts under President Trump may test this momentum. For now, Israel’s economic narrative remains one of defiance and success, even as the human cost in Gaza continues to mount.